GST: A critical reform that will drive economic growth.

By simplifying taxation norms, the new regulation will bring in transparency across sectors and encourage foreign investors to invest in India.

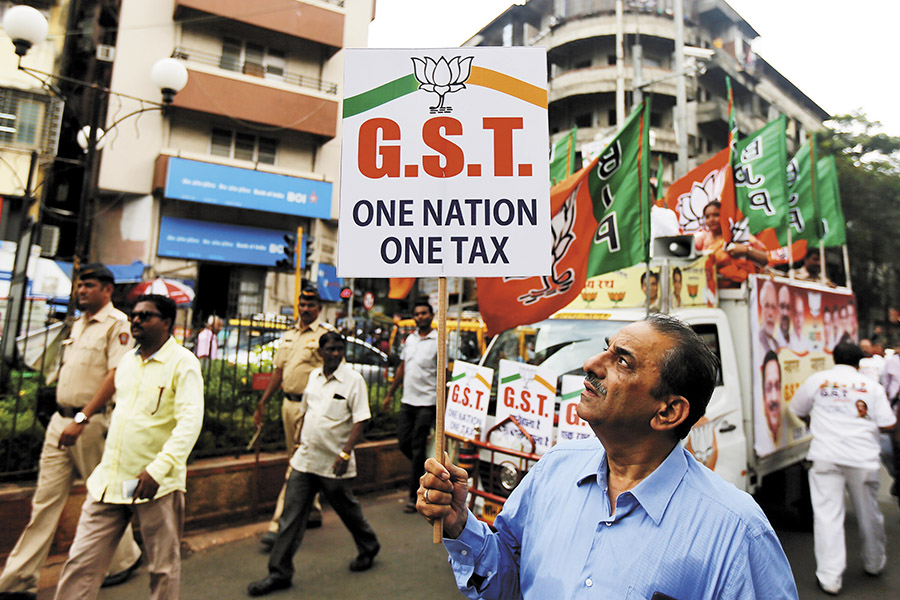

A BJP supporter participates in a rally supporting the Goods and Services Tax (GST). The tax, which was implemented from July 1, is expected to improve the ease of doing business and improve the overall economic outlook of the country (Image: Shailesh Andrade / Reuters)

At the stroke of midnight on the last day of June, India formally entered the Goods and Services (GST) Tax era. There is a lot of optimism about the new regime, but also some amount of apprehension. A lot of this concern revolves around the changes that the movement to GST entails rather than a fear of the regulation itself. Boost to FDISince GST is expected to have a massive impact across all sectors, the boost to Foreign Direct Investment (FDI) will also be significant. Overall, we will see a major shift from the unorganised sector to the organised one. With improved efficiency and productivity, India’s position as a leading market for FDI investment would be further enhanced. By simplifying the tax structure, the government is effectively incentivising foreign investors to increase their investment quantum in India.

Formalisation of MSMEs and MSME CreditGST is particularly important for the MSME segment—a large vector with close to 50 million units in India. These small units are burdened with the complex maze of taxes and compliances which, in turn, impacts their productivity. The ease of intra-state trade under GST would reduce some of the supply chain bottlenecks. The GST framework provides for availing input tax credit through the supply chain to avoid dual taxation. So, within a supply chain, the downstream enterprises would look to work with partners who have paid GST and documented the trade to avail credit. More enterprises, thus, would need to maintain documentation of production and sales bringing them under the ambit of taxation.

There is a significant credit gap in the SME financing space. The lending to many of these enterprises by private lenders and banks is restricted due to the unavailability of proper books of accounts and other documentation required for underwriting these loans. Better documentation would enable lenders to assess the cash flows of these enterprises and make them creditworthy. The validation of the books of accounts would also be easier with the wider tax database.

The writer is chairman and CEO of Edelweiss Group

The writer is chairman and CEO of Edelweiss GroupChallenges for banking and financial sectorsUnder GST, banks/NBFCs, which have pan-India operations, would need to obtain a separate registration for each state as opposed to a single ‘centralised’ registration followed previously. Besides, compliance burden about filing of returns has also increased—in terms of the periodicity of returns, number of return formats and level of details required in these returns.

Marginal hike in BFSI service taxWith the hike in service tax from 15 percent to 18 percent under the GST regime, certain services from BFSI (banking, financial services and insurance) will become marginally expensive. This will include fees levied by mutual funds, charges on banking services like ATM usage as well as part of the premium paid to insurance companies. However, the incremental benefit that the industry will accrue in terms of specific improvements across sectors like MSME and real estate, and generic improvements in industries across the board should far offset any potential downside to the financial services industry in the long term.

Base set for strong growthIt is estimated that from 2018-19 onwards, India should cross the 8 percent GDP growth rate driven by the organic improvement in the economy coupled with the GST upshot. Consumption is already on an uptick. The global economy is also improving and commodity prices have firmed up. So when you add up all this with the fact that oil prices continue to remain low, India is geared for strong growth going forward. In the long run, GST could potentially add 1.5-2 percent to the GDP and I would not be surprised to see double digit growth in the economy for a sustained period of time.

- Get link

- X

- Other Apps

Labels

News

Labels:

News

- Get link

- X

- Other Apps

Comments

Post a Comment